REIMAGINING REAL ESTATE SERVICES

Transforming Relationship between Next Gen Tenants and Landlords

In the ever-changing US rental scene, an innovative opportunity has arisen in Savannah, Georgia, a city with a mobile young population. This project aims to cater to the Millennial and Gen Z renters, emphasizing sustainability and social values. We've developed an apartment service model beneficial for tenants and property management alike, focusing on sustainability, enhanced professionalism, and addressing the challenges of frequent relocations.

Duration

10 Weeks

Year

2023

Nature of the project

Team Work

Type

Service Design | UX/UI Design | Interior Design

Role

Service Designer, Researcher

Tools

Figma, Paper and Pens, Lumion

Millennials and Gen Z are the majority in the evolving US rental market, with many planning to rent. In Savannah, Georgia, they make up 31% of apartment rentals. Yet, there is a swift evolution of tenant requirements and a lack of motivation among property staff. The demand for solutions is clear.

Challenge

The primary output of this project is the innovative "Evolution Map," a strategic framework that amalgamates diverse concepts to drive the transformative journey of apartment services. Additionally, the project includes a tenant-oriented incentivized Tenant Aid Network and smart Segmentation of public spaces to meet the needs of target users.

Outcome

We adopted a dual-centric approach to address these challenges, focusing on tenants and staff. Utilizing participatory co-creation driven by insights and data, we explored and developed a service implementation framework to guide staff and service prototypes oriented toward tenants.

Methodology

The strategies developed could potentially influence the lives of 14,648 individuals in Savannah and up to 12.05 million people nationwide. The project's customer-oriented solutions, such as the Tenant Aid Network app and smart segmentation of public spaces, have already garnered positive feedback in online interviews and surveys.

Impact

Part I Monitor & Frame (1st Round)

1.1 Integrative Research Approach: Unveiling Challenges and Opportunities in the Rental Market

To align with our initial objectives, we embarked on comprehensive research focused on the Savannah, GA region. This included observations, interviews, surveys, case studies, fieldwork, and document analysis. Our research team comprised two researchers, a service design leader, and a service delivery leader.

In the early stages, we employed a Stakeholder Map to pinpoint key players and a Stakeholder Prioritization Matrix to determine which entities required closer attention during subsequent research. To grasp both current and emerging market trends, we conducted a macro trend review, data analysis assessment, and competitor evaluation.

These strategies ensured our data collection and analysis were both efficient and thorough, leading to nuanced and actionable insights.

1.2 Cross-Sectional Stakeholder Engagement & Market Trend Analysis: Laying the Groundwork for Innovative Solutions in Property Management

From our initial findings, we recognized both tenants and employees as dual-centric in our approach. We started by pinpointing and ranking key stakeholders with stakeholder maps and a prioritization matrix. Following this, we delved into market trends using a macro trend review, data analysis, and competitor evaluation to grasp the present and anticipate future market dynamics.

1.3 Survey Insights: Understanding Millennial and Gen Z Expectations in the Rental Market

We gathered 192 survey responses from millennial and Gen Z tenants. The data showed that these groups, being dominant in the apartment rental market, have elevated expectations for amenities and services. They seek modern facilities tailored for remote work, among other needs. Yet, many traditional properties fall short of these expectations. Furthermore, property service companies frequently lack efficient communication channels for addressing tenant concerns, resulting in widespread dissatisfaction with service quality. These insights were pivotal in guiding the next steps of our project.

Archetypes for Tenants:

1. Guardian Tenant - Safety-conscious, community-engaged.

2. Collaborative Pathfinder - Tech and eco-conscious, values digital living and services.

3. Harmony Keeper - Cleanliness-conscious, proactive in waste disposal and maintenance.

4. Self-Sufficient Solvers - Independent, owning their living arrangements

Segments for APT Service Staff:

1. Master Orchestrator - Balancing tenant concerns, maintenance, and financial tasks.

2. Caretaking Handyhero - Handling repairs, facility upgrades, tenant satisfaction, and property durability.

1.4 From Research to Key Insights: Unveiling Tenant Needs and Market Trends in the Rental Sector

We conducted 11 in-depth interviews from our surveys: 7 with tenants and 4 with property staff. We found that millennial and Gen Z tenants often faced challenges like limited work/study spaces, financial pressures, and frequent moves, leading to a lack of essentials and life skills. These issues matched those of the Collaborative Pathfinder group, making them our project's target user group. Here are the key takeaways from our research:

Low wages and competence among property management staff are affecting the quality of service provided, raising concerns about the efficient functioning of property teams.

The Collaborative Pathfinder tenant group seeks rental spaces with household tools and larger work/study areas, reflecting their unique lifestyles and values. Property companies must adapt to these evolving demands.

In Savannah, regular tenant moves disrupt property companies' income and burden tenants with relocation and furniture expenses. This situation compels property firms to spend on upkeep, especially in older apartments, impacting their operations and tenant contentment.

Savannah's thriving used furniture market suggests tenants expect better in-apartment amenities. Property companies should upgrade their offerings to attract and retain tenants.

1.5 Experience Mapping: Unmasking the Post-Occupancy Challenges in Property Services

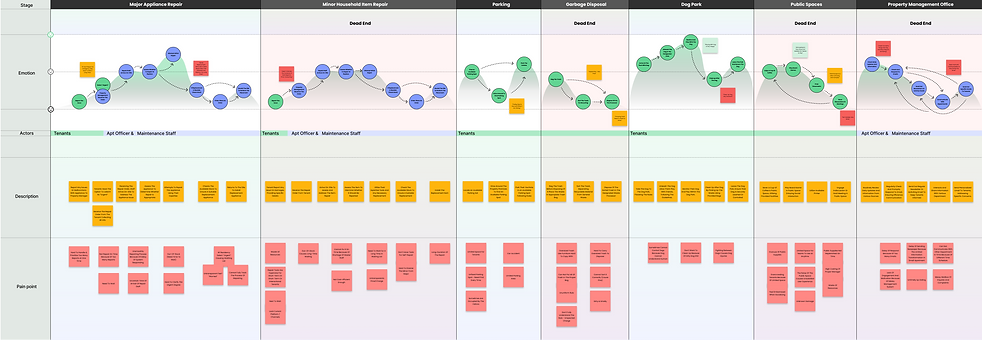

We created a dual-centered experience map for tenants and employees from our data. We identified the post-occupancy phase of the property service as the most critical area needing improvement. One interviewee noted, "After moving in, we face many service issues we didn't anticipate."

Part II Explore & Identify (1st Round)

2.1 Collaborative Workshop: Fostering Innovation and Stakeholder Involvement in Service Design

To enhance our service design, we organized a hybrid online and offline workshop involving key stakeholders. This included apartment tenants, a property manager, and a cleaning staff. Our goal was to tap into their insights to guide the project collaboratively. These workshops ensured everyone's involvement, from identifying issues to crafting solutions. This inclusive approach deepened our understanding of user needs and ensured our project catered to tenants and property staff.

First, we discussed and shared our previous findings and insights and validated the needs and expectations of apartment tenants and property employees in the experience map, as understanding user pain points and desires is key to designing a truly user-centric service.

Tenant Insights: Collaborative Pathfinder tenants prioritize high-quality remote work amenities, service, and affordability, assuming this will prompt long-term tenancy and referrals.

Property Staff Insights: Staff face turnover and maintenance issues, seeking to improve service while avoiding added stress, assuming this boosts job satisfaction and revenue stability.

Using the experience map as a foundation, we prompted participants to discuss and verify both known and potential project factors. This led to the creation of a thorough Risk & Assumptions Matrix. This matrix was instrumental in highlighting potential project challenges and guiding the development of strategies to tackle them.

1. Many apartment tenants in Savannah are dissatisfied with the facilities and services.

3. Savannah's apartment rental market targets young people who prioritize affordable rent and location.

5. Millennial and Gen Z tenants expect more from apartment amenities and services than what is currently provided.

2. The job of property management companies involves more than handling complaints; it includes rent collection, maintenance, and contract management.

4. Property management companies struggle with effective communication, leading to tenant dissatisfaction.

6. The rise in the used furniture market indicates a growing demand for better apartment amenities, which is not being met.

Simultaneously, we pinpointed different entities within the service ecosystem: beneficiaries, providers, enablers, and influencers. Together, we crafted an Ecosystem Map for the project. This exercise deepened our understanding of the service process's intricacy and the interplay between its various participants.

Concurrently, through this activity, we captured the aspirations of our tenants and employees regarding the future of our property services. From their vision, we derived the success criteria. These benchmarks will steer our service design project, ensuring solutions cater to both tenants and employees and align with the business objectives of property companies.

-

Improve tenant satisfaction by addressing relocation challenges.

-

Reduce employee work stress to enhance satisfaction and retention.

-

Deliver high-quality services for maintenance and remote needs.

-

Innovate service models leveraging the used furniture market.

-

Boost property companies' competitiveness and apartment occupancy.

During the workshop's final phase, we re-examined the Experience Map. We found that the "Experience during the lease stage" was problematic for both users and employees. This stage didn't match users' expectations or our success criteria. So, we decided to focus our project on improving the tenant's lease experience. Using our gathered insights, we started crafting "How Might We" (HMW) questions:

01.

How might we inspire more incredible passion for work through in-depth employee-centered research and a user-centered work model that creates a productive, satisfying, and decent work environment and enhances the tenant's apartment experience?

02.

How might we improve tenant and employee satisfaction by meeting the needs of millennial and Gen Z tenants for remote work and learning, addressing the financial stress of periodic moves, and finally improving communication between the property management company and the tenant?

Part III Monitor & Frame (2nd Round)

We conducted more employee-focused research to understand better the "Experience during the lease stage" phase. This involved phone interviews with 8 stakeholders, including tenants, property managers, and service staff. Each interview, lasting about 30 minutes, aimed to grasp their experiences, challenges, and expectations during the residential phase. These discussions helped us identify and confirm user needs and issues, guiding our next steps in service design.

Part IV Explore & Identify (2nd Round)

4.1 Insight Synthesis: Micro-Experience Mapping for Comprehensive Pain Point Analysis

From the interview results, we created a detailed micro-experience map of the current service during apartment occupancy. This map outlines property and staff procedures and highlights pain points. It provides a comprehensive view of the experience processes, touchpoints, and major issues. We'll compare these findings against our project goals and success metrics to inform our following actions.

After examining the experience map and comparing pain points to our success markers, we identified areas for optimization: cleaning and maintenance, services from the property office, and public facility services. We also saw a need to introduce apartment community services.

Our refined hypothesis became:

Part V Ideate & Visualize

5.1 Co-ideation Workshop & Prioritization: Harnessing Diverse Insights for Systemic Change in Property Management

Based on our hypothesis, we conducted a co-creation workshop, inviting stakeholders to suggest short-, medium--, and long-term solutions. Participants shared their expectations and visions. This resulted in a diverse set of MVP concepts, each with specific actions and associated stakeholders.

Given the dual focus on tenants and staff, we aimed for a broad spectrum of ideas to drive systemic change. We used a prioritization matrix to sift through these concepts. Stakeholder discussions created two matrices: an employee-centric impact vs. cost and a tenant-centric impact vs. effort.

After an affinity analysis, we grouped the ideas into five concept categories:

-

Proactive Employee Engagement

-

Tenant/Sustainable-Driven Services

-

Transparency & Responsiveness

-

Commercial Value Maximization

-

Dynamic Space Utilization & Management.

Part VI Prototype & Envision

6.1 Organization-facing outputs: Unleashing Innovation in Property Services Through Strategic Framework

Following meticulous analysis, we have curated a holistic service implementation plan and an insightful report incorporating a problem statement, stakeholder and ecosystem map, archetypes & segments results, experience map, insights result, evolution map, and qualitative and quantitative summative research.

Our innovative "evolution map" is a testament to our strategic approach, seamlessly blending various concepts to revolutionize apartment services. Our methodology delineates specific actions and introduces a staged implementation of these concepts. This step-by-step approach is crucial for sustainable growth and profitability at every phase. We've channeled this strategy into reshaping property services across five fundamental directions.

-

To address staff issues like high turnover and skill gaps, we've introduced staff engagement strategies. These include maintenance workflows, feedback systems, and improved KPIs to boost morale and performance.

-

Embracing the sharing and sustainable trends, we've introduced community-based tool rentals and second-hand furniture trading. This promotes community bonding, extends product use, and cuts maintenance costs.

-

For better transparency, we've launched an app that offers clear insights into service charges and real-time updates, enhancing user interaction.

-

Business-wise, we're exploring new revenue avenues like strategic partnerships, space leasing, and advertising to offset operational costs.

-

We're optimizing apartment public spaces with intelligent management, introducing functional zones and booking systems to cater to remote work needs, and improving the overall living experience.

6.2 Turning to our customer-facing outputs: Reinventing Tenant Experience Through Intelligent Service Solutions

Aligned with our "evolution map," we've introduced user-focused innovations like intelligent public space segmentation, real-time service alerts, and a Tenant Aid Network for community-driven trading and tool rentals. This led to development of the Tenant Aid Network app, a unified platform for trading, rentals, and community support, ensuring a smooth user experience. We've also revamped indoor public spaces in apartments, creating dedicated areas for remote work and study. This approach not only improves services but also strengthens the bond between tenants, staff, and communal areas.

Part VII Prototype & Envision

7.1 Assessing Future Rental Services: Testing and Fine-tuning our Approach for Impact

With these initiatives, we're paving the way for a more interconnected, user-friendly, and dynamic living experience, driving toward our evolution map objectives. Our project, built on an exhaustive study of Savannah's property services, aims to create a transformative impact for both property service providers and tenants. Collaborating with industry professionals, we've managed to craft strategies that could affect 14,648 individuals in Savannah and up to 12.05 million people nationwide (Savannah, Georgia Rental Market Trends 2022; Household Characteristics 2021).

Our focus is now on refining these strategies, evaluating actual costs, and conducting small-scale feasibility tests. This approach will allow us to fine-tune our initiatives based on real-world feedback, which is integral to our successful rollout.

To ensure our customer-oriented solutions hit the mark, we've used online interviews and surveys to test the concepts. The feedback on our Smart Segmentation of Apartment Spaces, Tenant Aid Network (TAN), and Real-Time Service Request Updates has been positive: 77.1% of respondents believe in smart segmentation for remote needs, 76% support TAN for trading second-hand furniture, and staggering 85.8% desired real-time service updates.

Despite this promising feedback, we recognize that our sample size might limit our study's universality. Therefore, the next step necessitates the involvement of specialized teams such as UI and interior design professionals for systematic viability, feasibility, and desirability testing. This will ensure we provide a detailed, robust, and effective service for all tenants.

Reference

Gans, J. (2023, April 29). Nearly three-quarters of millennials are living paycheck to paycheck: Report. The Hill. https://thehill.com/business/personal-finance/3979656-nearly-three-quarters-of-millennials-are-living-paycheck-to-paycheck-report/

Gen Z statistics: What we know about them - rentcafe. (2022). https://www.rentcafe.com/blog/gen-z-statistics/

How millennials are reshaping the rental market: Some plan to rent forever. Geraci Law Firm. (2022, December 8). https://geracilawfirm.com/the-originate-report/how-millennials-are-reshaping-the-rental-marketsome-plan-to-rent-forever/#:~:text=In%20a%20November%202019%20national,10.7%25%20just%20one%20year%20ago.

Savannah, Georgia Rental Market Trends. Point2. (2022). https://www.point2homes.com/US/Average-Rent/GA/Savannah.html

Last Updated: July 12. (2023, June 15). Property Management Industry Statistics & Trends [2023]. iPropertyManagement.com. https://ipropertymanagement.com/research/property-management-industry-statistics

Berg, B. (2021, April 12). The Fast Furniture Problem. Architectural Digest. https://www.architecturaldigest.com/story/sustainability-fast-furniture

Admin. (2019, August 6). The circular economy - What is it and why does it matter? Recycle Track Systems. https://www.rts.com/blog/the-circular-economy-what-isit-and-why-does-it-matter/.

Bischof, H. (2019, May 30). Fast furniture: what's wrong with it and 7 ways to make better choices (for you and the planet). Medium. https://heidibischof.medium.com/fast-furniture-whats-wrong-with-it-and-how-to-start-giving-acrap-about-our-planet-and-eb780bf74de9.

Cannon, J. C. (2018, August 10). How Furniture Demand in America Thins Forests Across Central Africa. Pacific Standard. https://psmag.com/environment/africandeforestation-is-affected-by-american-furniture-demand.

Household characteristics. NMHC. (2021). https://www.nmhc.org/research-insight/quick-facts-figures/quick-facts-resident-demographics/household-characteristics/